Digital Banking

Create your own digital banking product with our seamless APIs

With our API-based Banking-as-a-Service platform, you can build your own digital banking product with a high degree of flexibility and a fast time to market.

Fully branded and licensed

No matter whether you are creating a solution for businesses or consumers, our APIs empower you to offer digital bank accounts with an array of engaging features. All of our APIs are white-labeled, so you can embed our banking features into your product environment with your branding. In addition to our headquarter in Germany, we have active branches in France, Italy, and Spain, so we equip you to offer local IBANs in these countries.

Packed with modern features

Our APIs bring your banking offering to life with engaging and convenient features.

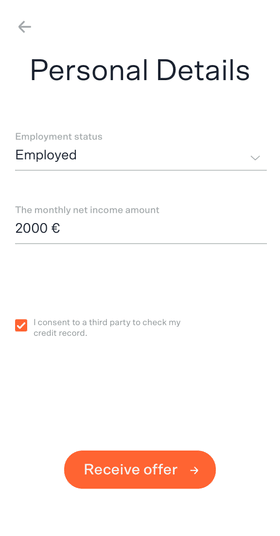

01Overdraft

Enable your customers’ financial flexibility with an overdraft by lending them a certain amount of money up to a set limit to temporarily increase their cash flow.

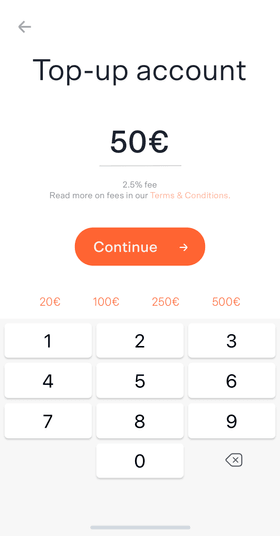

02Instant Card Top Up

Enable your customers to easily deposit money into their bank accounts with any credit or debit card or via Google/Apple Pay.

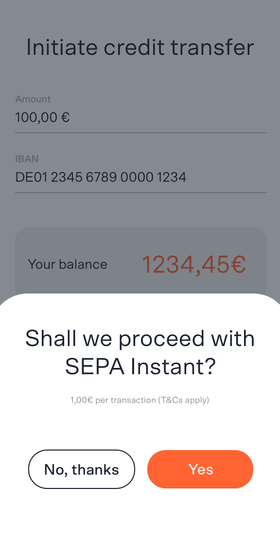

03SEPA Instant

Empower your customers to send and receive transfers within seconds if the sending and receiving banks are connected to the SEPA Instant scheme.

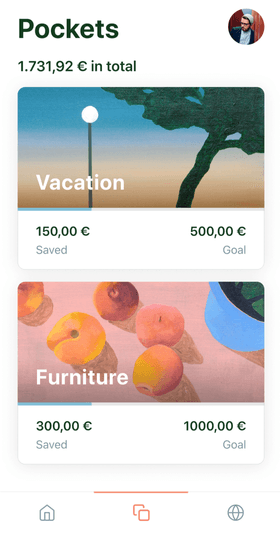

04Sub-Accounts

With sub-accounts, your users can achieve savings goals and manage their spending habits.

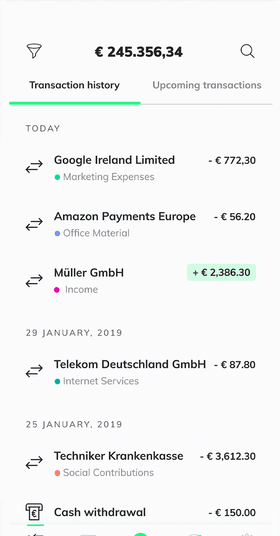

05Push notifications

Notify your customers in real time when transfers arrive, direct debits are made or card transactions are completed.

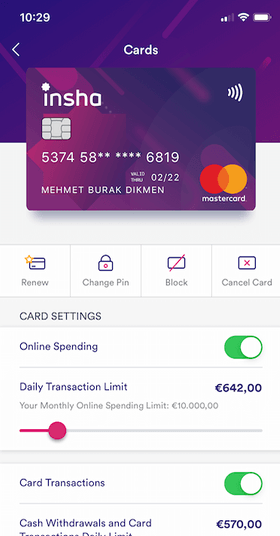

06Limit setting

Give your customers the full control by enabling them to set their own card limits and even block and unblock their card at any time.

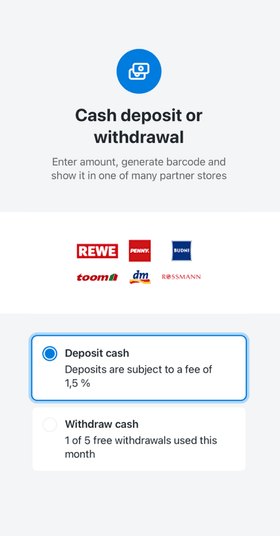

07Deposit/withdraw cash

With the ViaCash feature, your users can deposit or withdraw cash at the cash registers of thousands of partner shops in Germany.

Your Company

Digital Companies

Fintechs

Banks

Corporates

Want to build your own digital banking solution? Partner with us and get started!

Talk to usYour Card. Your Design.

Interested in adding your own branded prepaid, debit, and credit cards to your banking offering?

See our cardsYour benefits

Cross Border Expansion

Our APIs are built for scalability. We can passport our full German banking license into 30 EEA countries, enabling you to expand your banking product internationally.

Fast time to market

Benefit from technical and legal readiness within a few weeks.

Mix and match

Easily combine our Digital Banking API with further Solaris solutions such as the issuing of prepaid, debit, and credit cards or digital consumer loans.

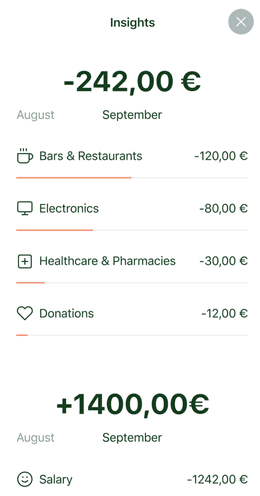

Engage your customers

We use our banking services practically everyday. Boost your number of customer touchpoints and gain valuable insights into your customers' spending behaviour.

Tap into new revenue streams

Expand your product offering with state-of the art banking features, opening up a multitude of new income streams to complement your core business.

Tailor your offering

We help you to build exactly the banking experience your customers want. Our versatile APIs can be utilized for countless use cases.