Fronting

Offer digital loans to your customers on your terms

With our white-labeled loan and receivable fronting service, we enable you to offer your retail and business customers tailor-made financial solutions entirely in your branding.

As a fully licensed bank, we cover all regulated steps of the lending process for you.

Your customers. Your brand.

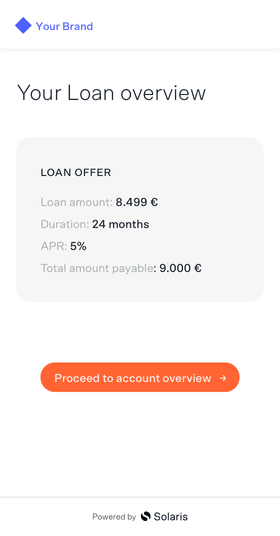

From loan origination to payout, our process complies with all banking regulations, is fully automated and integrated into your front-end via API. Meanwhile, you can propose the risk scoring model based on your risk appetite and expertise and keep a substantial say in loan pricing, servicing, and repayments.

How it works

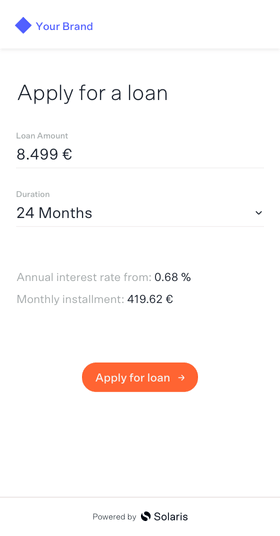

01Your customer

Your customers apply for a loan or receivables financing via your user interface. No paperwork is required.

02You

You propose a scoring model and a price for the loan based on your expertise and risk appetite.

03Solaris

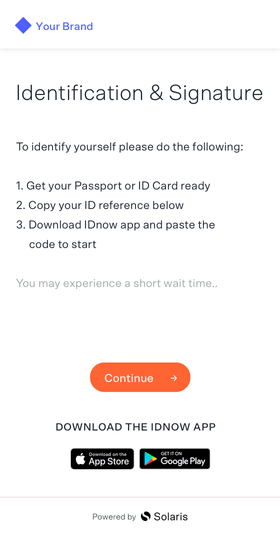

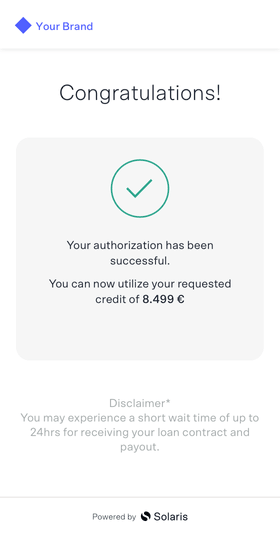

In your front-end, Solaris identifies the customer through our fully digital KYC process. After successful identification and scoring, Solaris issues the loan and pays it out or purchases the receivables.

04Your balance sheet or refinancing vehicle

The loan agreements or receivables are immediately sold and transferred to yourself or a qualified party selected by you that finances and services the loan, allowing you to retain full ownership of customer relationship along the entire loan lifecycle.

Enabling your embedded lending use case

Lending for self employed

E-commerce marketplace lending

SME Lending

Consumer Lending

BNPL

Revenue-based financing

Merchant cash advances

Let’s start offering tailored lending solutions together

Contact usYour benefits

Increased user retention

With Solaris, you remain the sole owner of your customer journey. By offering bespoke financing solutions you multiply your customer touchpoints and build long term relationships with your customers.

New revenue streams

With convenient and fast financing solutions you can unlock additional revenue streams through interest income.

Tailored market solution

With our Fronting Service, you can calibrate your preferred risk scoring. This enables you to leverage your customer data to offer highly competitive loan pricing and get an edge in the market.

Speed & convenience

Our automated Fronting Service creates a digital experience for your customers from start to finish and enables a rapid payout in as little as 3 minutes upon loan approval and successful identification.

Hear what our partners have to say

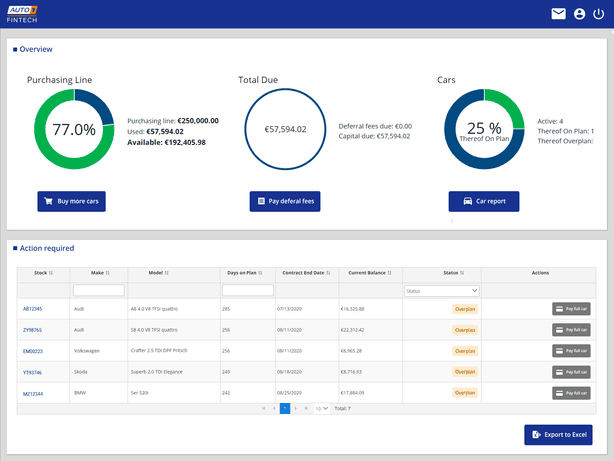

“Car dealers live from the fact that they buy cars quickly and get going. To do this, they need quick and uncomplicated loan approvals. Solaris’ automated loan origination enables exactly this, while allowing us to keep full ownership of our user experience.”

Head of Auto1 FinTech