Consumer Lending

The easiest way to offer consumer loans in your own branding

Our API-based solution enables you to integrate consumer loans directly into your product. Our swift application process is fully digital, paperless and mobile, allowing your customers to receive a credit decision as fast as 10 minutes.

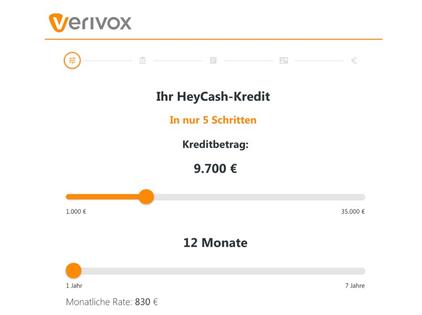

Fully digital loan application in your branding

Our white-label solution integrates seamlessly into your online applications, creating an unbroken customer journey entirely in your look and feel.

Ready for your business model

Challenger banks

E-commerce

Credit intermediaries

Whatever your business case may be, our adaptive APIs allow you to tailor your lending solution to your needs.

Talk to usYour benefits

End-to-end solution

Our comprehensive solution includes customer onboarding, identification, automated risk-assessment, pay out and regulatory reporting.

Flexibility

The initial underwriting and scoring process can be done by yourself or by us. Our risk sharing model allows for a flexible participation in the interest revenue based on your risk appetite.

Adaptive pricing

Our adaptive and risk-based pricing adjusts to meet your changing customer demands.

Access to our ecosystem

Our Consumer Lending API can be combined seamlessly with other Solaris offerings like overdrafts, accounts and cards.

Cross-border expansion

Our APIs are built to scale. We can help you expand your business internationally by passporting our full German Banking license into 30 EEA countries.

Fast time to market

Our white-label solution speeds up the lending process by automating the risk assessment and digitizing the authentication and signing process.